No, almost every accountant does this.

And believe me, they do this perfectly.

They are also good at their job and extremely reliable.

And yet … So where does it go wrong?

What don’t they say?

A simple calculation

Can I first ask you a short, simple math question?

And that you try to answer it in about 10 to 15 seconds?

It’s coming.

Imagine getting 1 cents from me.

So € 0.01.

And imagine this one cents doubling every day.

So when are you a millionaire?

Within a month, two months, half a year, a year, 5 years, 10 years, 20 years, 50 years?

What do you think? Do you already have an answer in your head?

That’s great.

Click here for the correct answer.

And?

Did you guess right?

I bet not.

Why?

Our brain is difficult to think exponentially. Just think back to the corona pandemic and the speed with which it took place. Even the brightest scientists have underestimated the power of exponential growth.

By the way, there was once a scientist who did understand…

Why am I telling this story?

Because this is the most important financial consideration for the issue of e.g. or sole proprietorship.

Let me explain.

And I do that quite specifically.

Because I’m pretty sure you’ve never heard this from anyone.

This is what everyone always does (and that’s not enough)

When considering bv or sole proprietorship, almost every advisor looks at two parts: taxes and liability.

Even at the Chamber of Commerce you can see this.

And despite the fact that these are two very relevant parts for the consideration of e.g. or sole proprietorship, they forget the most impactful part:

Yield.

Yield?

How?

How?

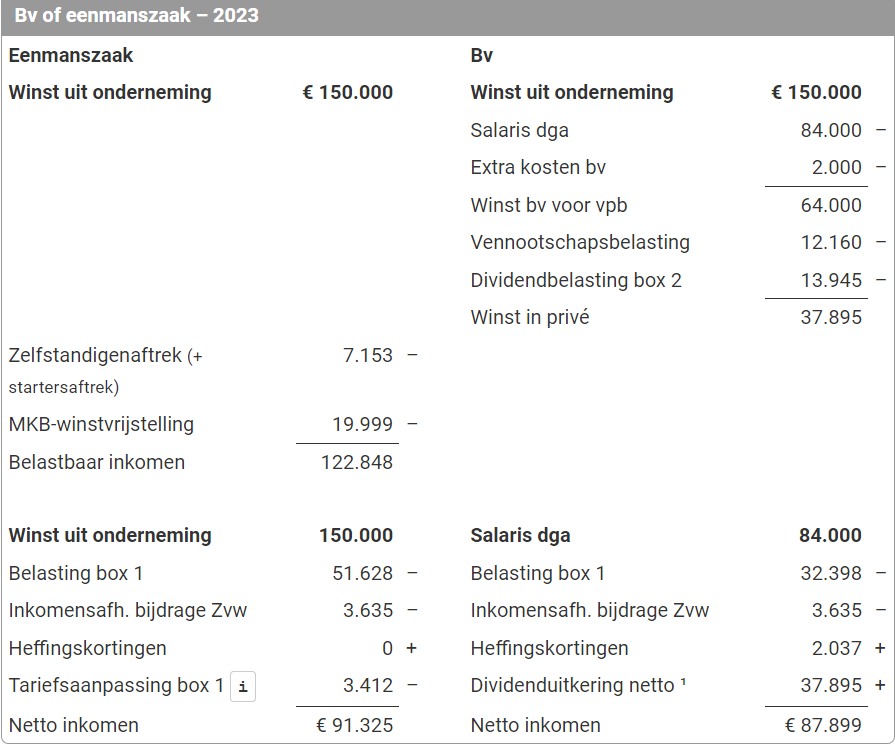

I like to explain this on the basis of a calculation (via berekenhet.nl).

Imagine the following:

You now have a sole proprietorship and you have a profit of € 150,000,-. You wonder if a bv makes sense and you have a calculation made.

The calculation takes into account € 2,000 extra costs for the bv. That is right, because a private limited company simply involves more than a sole proprietorship.

The calculation then looks something like this:

By first comparing different savings accounts, you can easily find the highest interest rate for your savings. Find the highest savings rate.

This, of course, does not seem realistic.

I get that.

Because fairy tales don’t exist, right?

And yet I want to make an attempt to prove it to you.

Because I know from experience that you underestimate the interest-on-interest effect.

You probably did that when calculating that one euro cent

You probably did that with the corona pandemic

And you probably do the same with the sole proprietorship issue

That’s why I’m sharing a free video with you. The video is about:

“How you almost certainly win € 287,000 with the bv form”

In the video I start from the example as given above and make a comparison between the sole proprietorship and the bv form. And then with and without return. Using accredited, professional estate planning software.

All you have to do to receive this free video is

After entering your first name and e-mail address you will receive the free video about:

“How you almost certainly win € 287,000 with the bv form” directly via e-mail.

So that you can make an informed decision whether the sole proprietorship is still the right form for you.

Or that you still have to consult with the accountant to set up the bv form.

So ask yourself:

Is it worth investing about fifteen minutes of your time to win tens of thousands of euros (or more) in the long run?

It seems like an easy answer.

The choice is yours.

Thanks for reading.

Greet

Ronald Sier

Owner and wealth planner Beyond Numbers